- What's Drippin'

- Posts

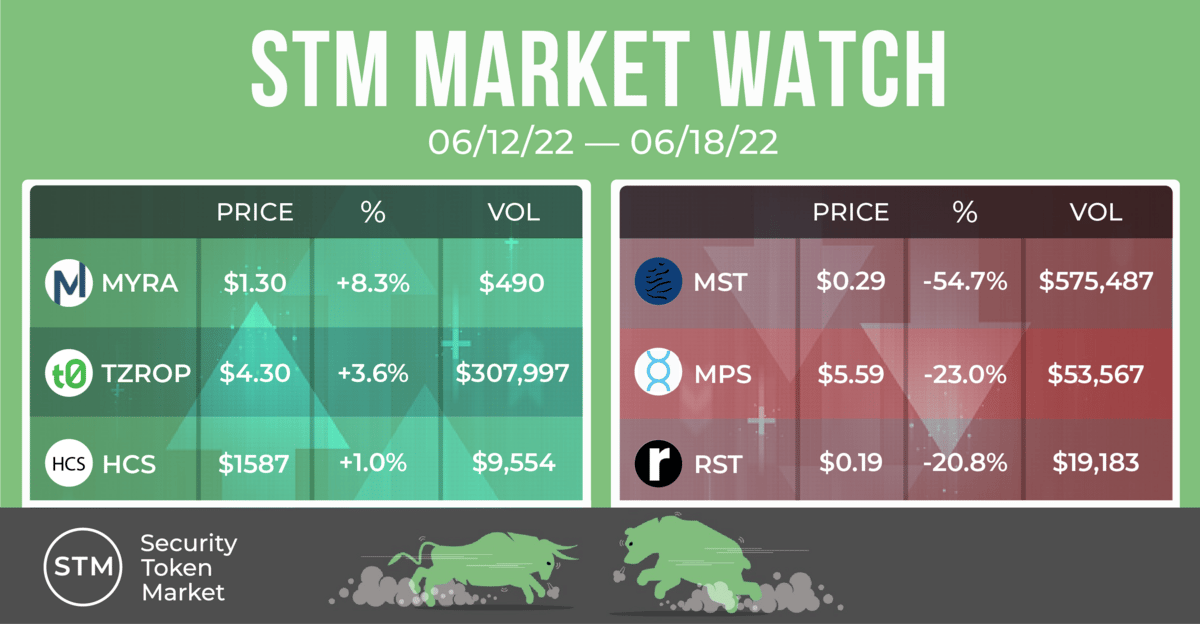

- 📈 💼 tZERO is goin' through changes

📈 💼 tZERO is goin' through changes

A new token listing could be the catalyst we need!

The Security Token Market CROWDFUND OFFICIALLY HAS A LAUNCH DATE!

This will be publicly announced tomorrow, but since you are a loyal subscriber - I wanted to let you know first.

Hint: It goes live in the first week of July!

Are you ready to invest yet?!

We are more than 20% beyond capacity with more than $6.6M pledged from 1,179 people around the globe!

Gooood morning, Rainmakers! ☀️

As always, I have two captivating topics for you to dive into:

1️⃣ 🧾The new crypto bill has it all: The new bipartisan bill appears to hit the nail on the head on what we desperately need!

2️⃣ 📈 💼 tZERO is goin' through changes: New high-profile executives and a change-up with the tokens trading!

Without further ado, it's time to…

Get liquid 💧

🧾The new crypto bill has it all

Let's start this section with a powerful quote:

"We’re regulating this 21st-century technology with 20th-century regulations. It’s time for an upgrade, and the Lummis-Gillibrand plan accomplishes that."

I don't think there's a better quote that really sums up the current state of the industry.

The funny thing is…

The definition of a security was established by the SEC in 1946 and obviously did not take into consideration any digital assets or securities.

In the year 1946, we were celebrating the end of WWII, and infatuated with Marilyn Monroe 😍

This tells me we need a major revamp of what constitutes a security or not.

Luckily for us, U.S. Senators Kirsten Gillibrand (D-NY) and Cynthia Lummis (R-WY), introduced the Responsible Financial Innovation Act, which is a landmark bipartisan legislation that will create a complete regulatory framework for digital assets.

I've seen a lot of bills and this one seems to hit the nail on the head on what we desperately need.

Here are a few takeaways from the bill with my thoughts in blue:

Creates a clear standard for determining which digital assets are commodities and what types are securities, providing clarity and structure for businesses and regulators

Love this because we need to demarcate what is a security and what is a commodity. Many people argue all cryptos are commodities, while others say securities. I think there is a little bit of both right now.

Assigns regulatory authority over digital asset spot markets to the CFTC.

Defines and creates requirements for stablecoins that will protect consumers and markets and promote faster payments.

There's a lot of uncertainty on where the stablecoins reserves come from, so I think clarity around that would boost a lot of people's confidence levels.

Requires a study on digital asset energy consumption

So much speculation and concern around the energy consumption (especially PoW) of miners and crypto -this would be great to have an official study conducted and analyzed.

Directs the CFTC and the SEC to study and report on the development of a self-regulatory organization (SRO) and develop a proposal for its creation.

Provides a regulatory sandbox for state and federal regulators to collaborate on innovative financial technologies.

This reminds me of Singapore's regulatory sandbox and something that has drastically helped Singapore be in the position they are in today. This sandbox will allow issuers to experiment right alongside regulators to determine the feasibility on all types of blockchain use cases.

There are a lot of great attributes in this bill and even if this bill isn't passed I hope some of these are at least looked at.

Read more about it here:

📈 💼 tZERO is goin' through changes

In the last few months, tZERO has gone through some pretty hefty changes, but that's not necessarily a bad thing.

For starters, they added three financial markets experts to their repertoire.

Their new CEO, David Goone was previously an executive at ICE (parent company of the NYSE).

Additionally, in lieu of the significant minority stake investment the NYSE took in tZERO, they appointed two more individuals to the Board of Directors:

Edwin Marcial, former Senior Vice President and founding Chief Technology Officer of ICE

Michael Blaugrund, COO of NYSE

CEO, David Goone had this to add on the new appointees:

Looks to me that tZERO is well-equipped to help take this industry to the next level.

The new appointees haven't been here long, but they seem to already be making serious moves.

If you didn't notice, the OSTKO security token has officially stopped trading altogether.

The reason behind this was to eliminate confusion on the three different share classes and convert them all into one.

From the surface, it appears like it could be a big hit to the industry because it was one of the leading security tokens, but tZERO has bigger plans.

It's been a little bit delayed, but the listing of XY labs appears to be imminent.

And let me tell ya, this listing may be a catalyst for security token trading volume.

Why?

There are 24,000 shareholders who have a stake in XY Labs looking for a liquidity solution and they are about to get it!

XY Labs is about to get liquid.

On top of that, Realio announced they would be choosing tZERO as their listing destination for the RST security tokens.

2022 is shaping up to be the year of security tokens!

💦 What else is Drippin’

Goldman Sachs begins trading its first-ever Ethereum derivatives products: TradFi meets DeFi once again.

Rich Glory Coin STO: A new STO is available on Securitize!

Class Action Suit Accuses Binance.US Of Securities Fraud For Misleading LUNA/UST Investors: The LUNA fiasco has just only begun.

Everything in this report is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this market report should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.

Disclosures:

• No money or other consideration is being solicited, and if sent in response, will not be accepted;

• No offer to buy the securities can be accepted and no part of the purchase price can be received until the offering statement is filed and only through the platform of an intermediary (funding portal or broker-dealer); and

• A person’s indication of interest includes no obligation or commitment of any kind.